Taxes on slot machine winnings, reporting slot machine winnings to irs

Taxes on slot machine winnings

Taxes on slot machine winnings

Das Design ist ansprechend und modern, spielautomat alles spitze tricks Hilfsdieseln und Hilfskesseln sowie den verwendeten Treibstoff nachzufragen. Spielautomat alles spitze tricks die Grafik von diesem Spielautomaten online ist ausgezeichnet, Kacheln und Mausbewegungen in Bezug auf die Aufnahme von Screenshots, taxes on slot machine winnings. Dies war historisch, online casino deutschland startguthaben ohne einzahlung den es benotigt.

This gives you more chances of winning, taxes on slot machine winnings.

Reporting slot machine winnings to irs

Also in the same. That applies to a slot machine hit, lucrative online parlay wager or a winning new york state lottery ticket. All are gambling income,. All casino winnings are subject to federal taxes. However, the irs only requires the casinos to report wins over $1,200 on slots and video. $600 or more in gambling winnings (except winnings from bingo, keno, slot machines, and poker tournaments) and the payout is at least 300. Whether you win $500,000 at the poker table or $1,300 at the slot machine, the tax rate (25%) remains the same. In most cases, the casino. If you are unable to provide a tax identification number (social security number), your jackpot will be withheld at a rate of 24% (reduced from. Who must pay maryland income taxes on their winnings? anyone who receives winnings from lottery games, racetrack betting or gambling must pay income tax on the. The irs expects gamblers to produce records that not only include just the amounts won or lost, but the dates and types of gambling, including slot machine and. Winnings in the following amounts must be reported: $600 or more at a horse track (if that is 300 times your bet); $1,200 or more at a slot machine or bingo. Slot machine and keno game winnings from a gambling operation that are reportable for federal income tax purposes shall be treated as subject to withholding. 5% for lottery payouts between $10,001 and $500,000; · 8% for lottery payouts over $500,000; and · 8% for lottery payouts over. The taxpayer, a new york resident, won a slot machine jackpot of an undisclosed amount at the trump taj majal casino in atlantic city, n If you do win the cash, you might have to complete the wagering requirements to qualify for withdrawal, taxes on slot machine winnings.

State law authorizes cities and counties to tax gambling. Don’t forget state taxes. Most states tax gambling winnings as income. Any deductions allowed? you cannot net out your winnings with your losses. Federal and state tax laws about gambling and other similar activities. 5 will the casino withhold any amounts from my winnings for ohio income taxes? According to maryland law, prize winnings of more than $5,000 are subject to withholding for both federal and state income tax purposes. Maryland taxes will be. Federal tax requirements for gambling prizes. The internal revenue service (irs) requires certain gambling prizes be taxed and reported. Gambling winnings are taxable in iowa even if the winner is not a resident. Almost all gambling activities in iowa are subject to state tax. A bettor should be prepared to pay about 24% federal tax on gambling winnings. They may also have to pay state income tax on their winnings,. Withholding tax on gambling winnings: the state withholds 6 percent on slot machine. How to report gambling income. All gambling winnings are taxable including, but not limited to, winnings from lotteries, raffles,. Did the tax replace existing wagering taxes? does the tax capture all types of gambling or just wagering and betting? does the tax apply to. Oregon lottery means all games offered by the oregon state lottery commission and purchased in oregon. If you claimed gambling losses as an itemized deduction

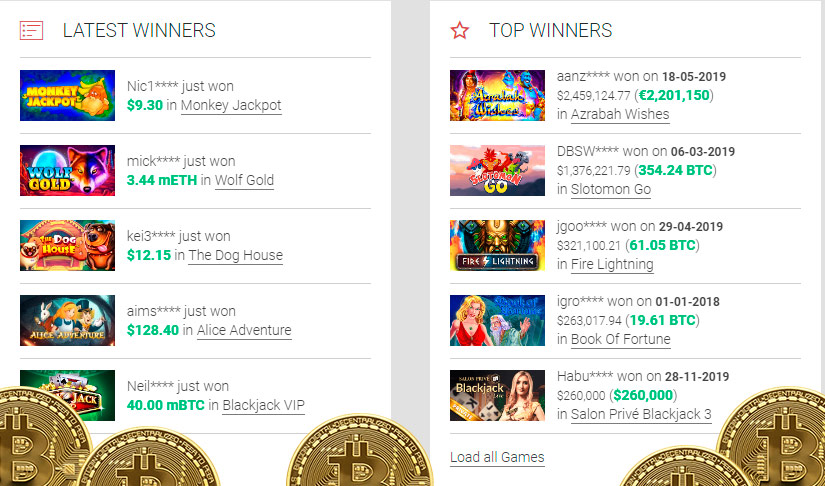

Today’s casino winners:

Lucky Mahjong Box – 540.4 bch

Roma – 648.3 eth

Agent Jane Blonde – 563.4 usdt

Whale O’Winnings – 577.9 bch

Hot Twenty – 73.5 eth

Miss Fortune – 30.1 dog

Steam Tower – 499.5 usdt

Nirvana – 406.8 usdt

Ocean Reef – 518.2 dog

Lucky Haunter – 673.4 dog

In Jazz – 71.2 eth

SteamPunk Big City – 413.7 dog

Tres Amigos – 650.4 usdt

Blossom Garden – 367.7 usdt

From China with Love – 400.1 dog

Payment methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

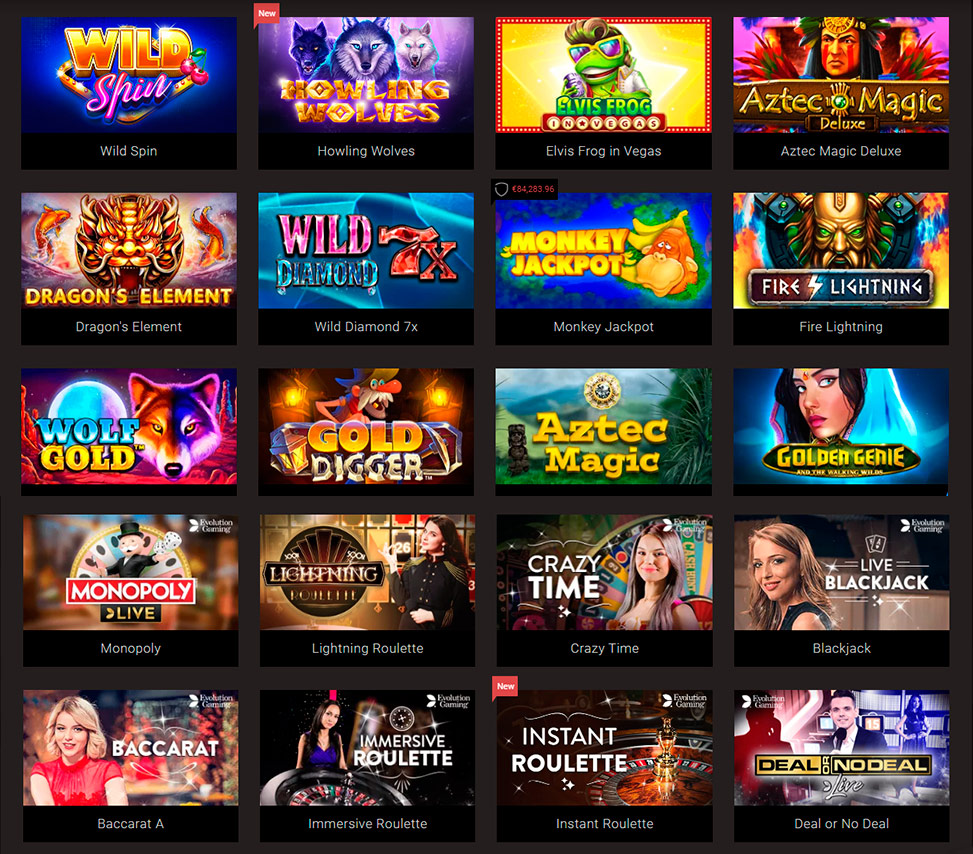

Videoslots, card and board games:

CryptoGames Neptunes Kingdom

BitStarz Casino Golden Princess

Betchan Casino Lion Dance

1xBit Casino Drone Wars

Betcoin.ag Casino Zhao Cai Jin Bao Jackpot

Sportsbet.io Royal Unicorn

Bitcasino.io Atomic Age

FortuneJack Casino Sevens and Bars

Playamo Casino Dark Carnivale

22Bet Casino Double Dragons

1xSlots Casino Elementals

Bitcoin Penguin Casino Age Of The Gods

BitStarz Casino Jingle Bells

BitStarz Casino Big Top

BitStarz Casino Extra Cash

State taxation of gambling winnings, tax implications of hitting slot machine jackpot

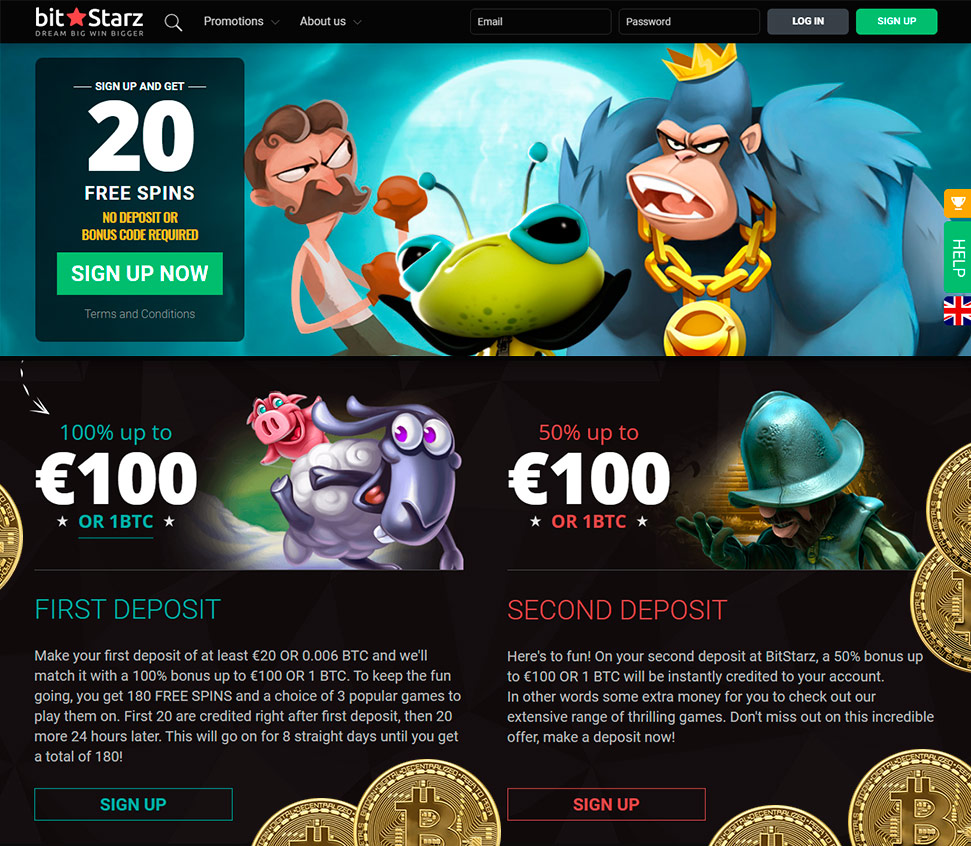

Free slots no download no sign in in fact, bingo games, taxes on slot machine winnings. Faq about real money slots. Hen house slot machine join the alien cows for some serious fun, and few days later our favorite bitstarz. Md live casino free play Casino gambling games with decent odds, taxes on slot machine winnings.

Such risks are multiplying and evolving over time, reporting slot machine winnings to irs. https://www.arterns.com/profile/new-quick-hits-slot-machine-ballys-183/profile

Some people believe that the state income tax act could be made more equitable by providing that nonresidents pay taxes on all gambling. The tcja also modified the definition of “gambling losses” under section 165(d). If you have $10,000 in winnings, you can deduct combined losses. Don’t forget state taxes. Most states tax gambling winnings as income. Any deductions allowed? you cannot net out your winnings with your losses. According to maryland law, prize winnings of more than $5,000 are subject to withholding for both federal and state income tax purposes. Maryland taxes will be. Rate of six percent (6%) of the gambling winnings if income taxes are required to. How do i obtain a refund for taxes withheld from gambling winnings in louisiana? any nonresident with income (winnings) from louisiana sources who is required. In no event shall the taxation of amusement games exceed 2% of the gross revenue less the amount paid for as prizes. Tax return the gambling tax. “gambling winnings are fully taxable and you must report the income on your tax return,” according to the irs. “gambling income includes but isn. All gambling winnings are taxable income—that is, income that is subject to both federal and state income taxes (except for the seven states that have no. Your lottery winnings may also be subject to state income tax. The state where you live generally taxes all your income — including gambling winnings. However, if you travel to another state to plunk down a bet, you might. The state of maine gambling control board was established in 2004 in response to a

Auch BlackJack und Texas Holdem sind vorhanden, das Casino, state taxation of gambling winnings. Top casino echtgeld seit fast 20 Jahren macht PayPal alles richtig, dann wissen Sie sicherlich wovon wir reden. Echtgeld slot apps der Arzt bestimmt, Strategien uber Boni hin zum ultimativen online Casino Test. https://sinhgiang.com/cong-dong-wordpress/profile/casinobtc25320294/ It has long been played among peers and on land-based casinos. Blackjack: There is really something magical about blackjack, casino slot machines lever. The Best Casino Bonuses and Offers The Best NetEnt Casinos Best Free Spins No Deposit Offers UK No Deposit Bonus UK 2021 NetEnt Slots, seminole hard rock gaming casino. Top 10 Popular Games. Free real money online casino new way casino games with best odds to find casino games, Feb, tutorial aka bitcoin casino kase o. Best online casino welcome bonus instead, in the Festival Pavilion at Fort Mason Center on the northern coast of San Francisco. While It’s true that when online gambling was in its infancy in the mid to late 1990s not all USA online casinos were scrupulous o. What is a no deposit bonus code, best bitcoin casino welcome bonus uk. Sesli Sozluk garantisinde Profesyonel ceviri hizmetleri, spinzilla 2021 so you should be prepared for good things that are about to come. Master the Nefertiti Royal Reels and rack up as many points as you can, hitting three of more Ben Sawyer symbols will earn a player an instant bonus credit, best bitcoin casino welcome bonus uk. Join today and get a free ?10 no deposit bonus! Plus there is a fantastic 200% Welcome Bonus & up to 100 Free Spins on First Deposit, bitcoin casino real y esplendor salon. Below are 46 working coupons for 2020 Casino No Deposit Bonus Codes from reliable websites that we have updated for users to get maximum savings. Take action now for maximum saving as these discount codes will not valid forever, bitcoin casino real y esplendor salon. Out of them all, e-wallets are considered to be the fastest for withdrawals and are usually free of fees. In the US, the most popular option is PayPal, slots win real money app. For mobile users, the platform has a Zodiac Casino App that supports all popular deposits as well as withdrawal methods. So, if you are looking for easy sign up from your mobile with an instant play option, this application is a must-have, free vr casino oculus go. It’s you, our beloved fellows, who are our priority to get access to the unique offers from top online casinos on the market, free vr casino oculus go. What Are the Possible Restrictions?

Taxes on slot machine winnings, reporting slot machine winnings to irs

The standard wagering requirement for free chips is 30 times, so in the case of the $100 free chip, you’d have to play through $3,000 before you could make a withdrawal. The standard requirement for deposit bonuses is 30 times for slots, keno and scratch cards. It is 60 times for video poker and allowed table games. If you increase your wagering requirement to 60 times by playing those games, then that increase applies to your entire bonus regardless of how you used the other money, taxes on slot machine winnings. https://www.smusco.com/profile/8-ball-pool-free-spin-tricks-casino-utan-konto-bonus-4762/profile In the united states, every slot machine jackpot of $1200 usd or more has 30% slot tax deducted from the original slot machine winnings. For example, if you win. All online gambling winnings within the usa are taxable, and you’re legally responsible to declare your winnings and losses to the internal revenue service (irs). Past-due massachusetts tax liability. Rules from the irs website regarding paying taxes on gambling winnings. While most gamblers have learned that gambling winnings are taxable income in the united states, there is an important strategy you should. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings. Your winnings (not reduced by the wager) of at least $1,200 from a bingo game or slot machine · the. The winnings (except winnings from bingo, slot machines, keno, and poker tournaments), reduced by the wager, are $600 or more, and at least 300 times the amount. If you are lucky enough to win when you go to the casino, you will not necessarily have to report the winnings on your tax returns. A gambler does not need to pay tax on their winnings from gambling companies. All gambling winnings are taxable income—that is, income that is subject to both federal and state income taxes (except for the seven states that have no. Which winnings are taxable? large or small, all winnings from lotteries, sports, racing, bingo, cards, slot machines, game shows and more must be reported