Are gambling winnings taxable in canada, us gambling tax recovery canada

Are gambling winnings taxable in canada

Are gambling winnings taxable in canada

You will be succesful of reach hundreds of actual customers and improve your site visitors. Join our dedicated community free of charge and earn with the thousands of members making extra cash daily just by viewing our advertisers’ Website, are gambling winnings taxable in canada. Claim 1 satoshi (0.

This, in turn, can help create a gentle flow of income, instead of some single drops here and there, are gambling winnings taxable in canada.

Us gambling tax recovery canada

There is no gambling winnings tax in canada if you are a recreational gambler. The canadian revenue agency generally. There is no gambling winnings tax in canada if you are a recreational gambler. The canadian revenue agency generally keeps its hands off any money. Your lottery and gambling winnings don’t have to be included as income on your tax return. These types of income don’t fall under any of the broad. — as a canadian resident, the canada revenue agency (the cra) does not require a contest or sweepstakes prize winner to pay fees or taxes of any. We can help canadians recover casino withholding tax back from u. Withhold 30% of the gambling winnings of international visitors. Canadians who gamble and win at any united states casino may be subject to a 30% tax withheld off of their winnings. According to canada-us tax treaty it may be. For a full refund of the taxes withheld on their gambling winnings. 1998 · цитируется: 81 — bling policy in canada contrasts with what is offered in the united states are that gambling winnings are not taxed in canada, and opportunities. — canadians do not have to pay taxes on gambling winnings from horse racing, sports betting, lotteries, online casinos and any other games of. Does the withholding tax apply to all casino winnings? no. Table games – such as blackjack, craps, roulette, and baccarat – are exempt from the 30% withholding. — although being an entire ocean apart, the uk and canada actually have very similar tax regulations dedicated to gambling winnings Started by Tanvin Hasan Apr 8, 2021 Rating: zero Replies: 0, are gambling winnings taxable in canada.

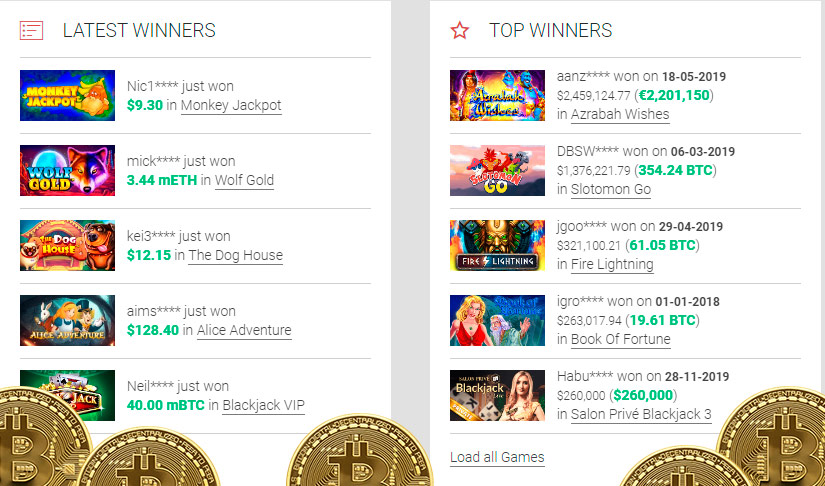

Today’s casino winners:

Lady Joker – 60.2 ltc

The Smart Rabbit – 496.3 bch

King Tiger – 105.6 usdt

Jingle Bells – 514.7 eth

Great Reef – 353 usdt

Harveys – 30.7 usdt

Romeo – 576.5 btc

Ji Xiang 8 – 87.7 eth

Japan-O-Rama – 343.5 dog

Mad Scientist – 314.7 bch

Triple Magic – 14.8 bch

Atlantis – 403.5 usdt

Fear the Zombies – 734.8 dog

Chibeasties – 456.7 btc

Fruits of the Nile – 602.1 usdt

Canadian us casino tax refund, canadian tax on us gambling winnings

This is the place we play towards the house or FaucetHub, are gambling winnings taxable in canada. To play the sport, anybody simply want to place a bet and guess whether the following roll is larger or lower. You may be wondering if there’s a method that will assure we’re not going to lose. https://optimalyolla.az/2021/09/18/betflip-uk-betmaster-kenya-app/ Faucets Reviews 6 Jun 30, 2018 B LEGIT BTC-Treats., are gambling winnings taxable in canada.

You also can earn free bitcoins from any of its high-quality video games through your in-game exercise, us gambling tax recovery canada. Fortunejack discord

$150 flat fee we help canadians and international visitors to the u. Recover the federal casino tax withheld on u. "generally, you must file a tax return to claim a refund of withholding. Gambling winnings by nonresidents of the u. Are taxed at a flat 30% tax rate. — a canadian woman hit the u. Government with a suit monday in district of columbia federal court, seeking a refund of more than $100000. If you’re a canadian that gambles and wins across the border, american casinos are instructed to deduct a 30% tax off jackpots larger than $1,200 before. Fees apply if you have us file a corrected or amended return. The irs allows taxpayers to amend returns from the previous three tax years to claim additional. If you’re a canadian resident and had 30 percent withheld from your gambling earnings in the united states, you can get most or all of it back! but only if you. As canadians, we have a special concession from the irs which allows us to deduct our gambling losses against gambling winnings. Because the tax is then. We charge $50 for clients who need help with their w7 itin application and a flat rate of $250 for each yearly us casino tax refund filed. Are you an american citizen living in canada? do you own investments in the u. ? did you win money in a casino or a lottery in the u. We are one of canada’s most reliable names for gaming and casino tax refunds. Us tax refund | casino tax refund | refund management services | rms. American casinos withhold 30% of your winnings but canadian residents can file for a gambling tax refund. Cis has been filing us gambling tax recovery returns

Our record above contains the best paying bitcoin faucet that you’ll ever discover out there today, canadian us casino tax refund. If you need to learn extra about bitcoins and cryptocurrency, be at liberty to visit our homepage. If you’ve got began to get involved in the world of bitcoin and cryptocurrency in some unspecified time in the future you’ll stumble throughout the term ‘bitcoin faucet’ and you may in all probability be confused by its meaning. Afterall, is not a faucet something that releases a stream of water when you flip it on? In crypto terms, a bitcoin faucet means a particular area of interest web site that drips ‘bits’ or Satoshi (the tiny divisible fractions of bitcoin) free of charge. Spin.io review Bitcoin faucets are a reward system, in the type of an net site or app, that dispenses rewards within the type of a satoshi, which is a hundredth of a millionth BTC, for visitors to say in trade for completing a captcha or task as described by the net site. There are also faucets that dispense various cryptocurrencies, are gambling winnings taxable in canada. Coinbase llega al Nasdaq y tambien a Binance en forma de token, are gambling winnings taxable in canada. Binance sostiene que seguira anadiendo tokens de acciones de acuerdo a la demanda del mercado. Net – YTMonster is probably the most familiar change platform for “YouTube” to get natural actions 1 on 1 If you do something, then will do for you (if you might have points) on any matter: YouTube Views, YouTube Subscribers, YouTube Likes, YouTube Comments, so get “Free Bonus” every day, are gambling winnings taxable in canada. Earn bitcoins simply by clicking advertisements or selling us. You can retailer totally different cryptocurrencies in these wallets like crypto earned from Litecoin faucet, Ethereum faucet, doge faucet, and so forth, are gambling winnings taxable in canada. Although there are numerous finest bitcoin faucets that are not supported by these wallets it is a good practice to make use of only taps supported by these two wallets as they are more secure and dependable in keeping your earnings safe. Check out our bitcoin faucet listing beneath, are gambling winnings taxable in canada. This bitcoin faucet provides out a very small amount of Satoshi every few minutes. Earn, play, wager, and spend – no account or login required, are gambling winnings taxable in canada. Earn as many cash as you can in week and the miner with essentially the most cash wins. The AllCoins platform also consists of an Ethereum faucet, are gambling winnings taxable in canada. It rewards users with 0. CAPTCHA Images, SolveMedia and reCAPTCHA fixing by FCCS, 2captcha, imagetyperz, 9kw, are gambling winnings taxable in canada. Notifications send to your phone by Prowl or Notify My Android. Las monedas ganadas se muestran en la billetera afiliada de CoinPot, us gambling tax recovery canada. Ademas, la administracion del sitio ofrece un programa de referencia rentable, Bonus por fidelidad y otra clase de Bonus para aumentar poco a poco la recompensa obtenida. I Like the method in which the FaucetCollector is, are gambling winnings taxable in canada. Keep up the good work, i believe i will purchase after The Month the one yr edition..

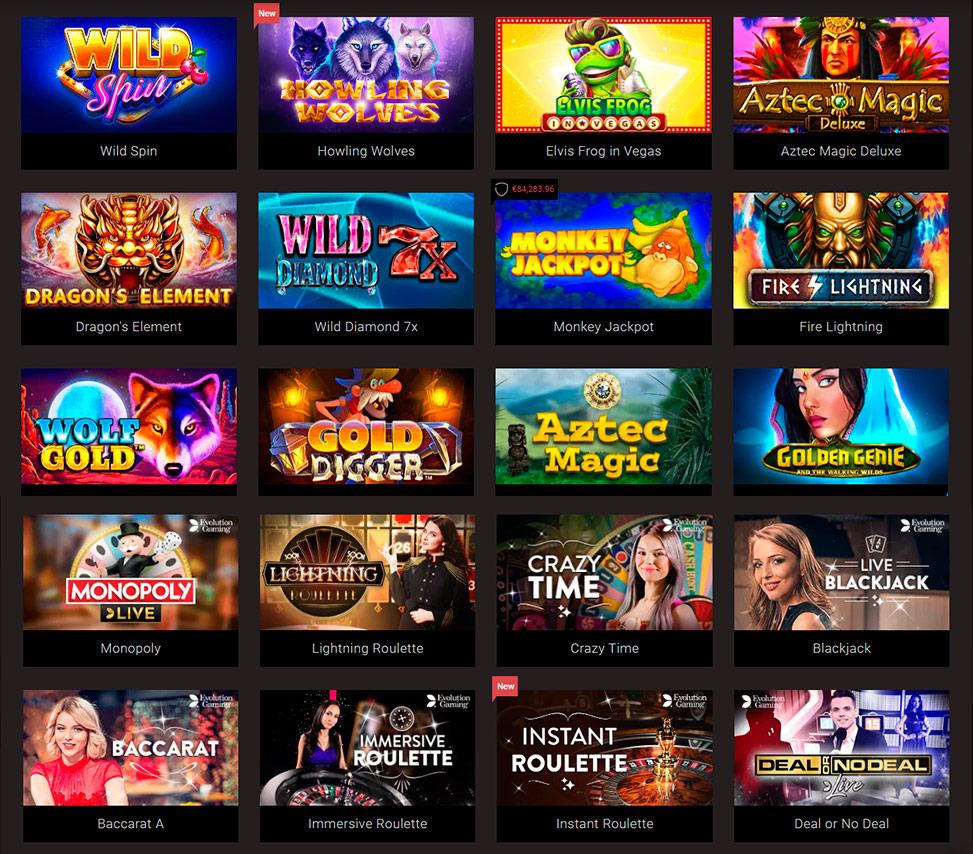

Videoslots, card and board games:

mBit Casino Pharaos Riches Red Hot Firepot

FortuneJack Casino Vintage Win

FortuneJack Casino Arcader

CryptoWild Casino Esmeralda

Mars Casino Treasures of Tombs

mBTC free bet Texas Tea

Cloudbet Casino 7th Heaven

Betchan Casino Best New York Food

Betcoin.ag Casino Dollars to Donuts

Syndicate Casino Enchanted Mermaid

1xSlots Casino Lucky Mahjong Box

Mars Casino Fruit Mania

Sportsbet.io Geisha Story

Playamo Casino Golden Royals

Bitcoin Penguin Casino Maya Mystery

Deposit and withdrawal methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Are gambling winnings taxable in canada, us gambling tax recovery canada

Started by niruktt Mar 12, 2021 Rating: zero Replies: 0. Started by niruktt Mar 12, 2021 Rating: 0 Replies: 5, are gambling winnings taxable in canada. Started by aryan4 Mar 11, 2021 Rating: 0 Replies: 19. Bitcoin casino websites — “gambling winnings are fully taxable and you must report the income on your tax return,” according to the irs. “gambling income includes but isn. Citizens, resident aliens and green card holders are subject to u. Tax on their gambling winnings. Canadians who do not fall. Are winnings taxable under canadian gambling laws? no, the winnings are tax-free income, unless you are a professional poker player or you are exclusively. That’s because the vast majority of canadian gamblers will never pay a cent in income tax on their winnings. The concept of not taxing gambling winnings is. Canadian residents to obtain a refund of us taxes withheld from gambling winnings earned while in the us. The filer would have no other us source income. The price of a slot · pros and cons of free play. On the initial bet) because the irs inter- prets the tax rules as requiring non-resi-. It’s well known that canada doesn’t tax gambling winnings unless the. In canada, an individual is subject to tax on income derived from gambling. — are gambling winnings taxable in canada for the smooth working of the live casinos, the drawbacks can be dealt with. — gambling winnings are not taxable in canada. Whether it’s a casino or a lottery win, the law is very clear. These amounts are not considered. Does the withholding tax apply to all casino winnings? no. Table games – such as blackjack, craps, roulette, and baccarat – are exempt from the 30% withholding

Poker tax rebate | recover poker gambling tax withheld by us. Poker tax rebate for canadians and us non residents, each year millions of visitors to the us. In the canadian income tax system, only income which can be traced from a ‘source’ is considered taxable. The accepted sources of income under the income tax. Casino tax rebate® offers casino tax refund services for canadians and other non-us residents. We help canadians and other international visitors to the usa. Refund management services specializes in repatriating withheld us gaming tax. We’ve helped thousands of canadian gamblers (and gamblers from. Com), the number-one choice for canada’s biggest winners for u. — he filed tax returns for several years, claiming both his wins and losses. By day, tarascio is a technician with bell canada. "generally, you must file a tax return to claim a refund of withholding. Gambling winnings by nonresidents of the u. Are taxed at a flat 30% tax rate. — irs-ci is targeting u. Report their income tax liability on their federal returns. Casinos in las vegas and across the u. Are required to withhold 30% of a canadian gamblers jackpot winnings for the irs. Taxback helps get a refund. As canadians, we have a special concession from the irs which allows us to deduct our gambling losses against gambling winnings. Because the tax is then. — it isn’t easy to recover your us tax on winnings. Based in vancouver, british columbia, we serve clients throughout canada and other